ECONOMISTS’ STATEMENT ON CARBON DIVIDENDS

Global climate change is a serious problem calling for immediate national action. Guided by sound economic principles, we are united in the following policy recommendations.

I. A carbon tax offers the most cost-effective lever to reduce carbon emissions at the scale and speed that is necessary. By correcting a well-known market failure, a carbon tax will send a powerful price signal that harnesses the invisible hand of the marketplace to steer economic actors towards a low-carbon future.

II. A carbon tax should increase every year until emissions reductions goals are met and be revenue neutral to avoid debates over the size of government. A consistently rising carbon price will encourage technological innovation and large-scale infrastructure development. It will also accelerate the diffusion of carbon-efficient goods and services.

III. A sufficiently robust and gradually rising carbon tax will replace the need for various carbon regulations that are less efficient. Substituting a price signal for cumbersome regulations will promote economic growth and provide the regulatory certainty companies need for long- term investment in clean-energy alternatives.

IV. To prevent carbon leakage and to protect U.S. competitiveness, a border carbon adjustment system should be established. This system would enhance the competitiveness of American firms that are more energy-efficient than their global competitors. It would also create an incentive for other nations to adopt similar carbon pricing.

V. To maximize the fairness and political viability of a rising carbon tax, all the revenue should be returned directly to U.S. citizens through equal lump-sum rebates. The majority of American families, including the most vulnerable, will benefit financially by receiving more in “carbon dividends” than they pay in increased energy prices.

https://www.wsj.com/articles/economists-statement-on-carbon-dividends-11547682910

https://www.econlib.org/a-case-against-a-carbon-tax-for-all-ideologies/

https://www.econlib.org/a-case-against-a-carbon-tax-for-all-ideologies/

|

| https://www.americanenergyalliance.org/2015/11/10-reasons-to-oppose-a-carbon-tax/ |

10 Reasons to Oppose a Carbon Tax

A “carbon tax” is a tax on energy. Through July 2015, over 80 percent of domestic energy consumption came from natural gas, oil, and coal. A carbon tax would impose an indirect tax on these fuels due to their carbon dioxide emissions. Below are ten reasons carbon taxes should be opposed:

1). It is a tax on transportation fuels like gasoline and most forms of electricity – 67 percent of our electricity comes from natural gas, coal, and oil. By design, a carbon tax will make affordable energy more expensive. Americans will see their utility bills increase under a carbon tax. To repeat, this is the purpose of a carbon tax: to make the existing energy infrastructure more expensive, forcing Americans to change how they live and work.

2). It will increase the cost of goods and services – More expensive energy means more expensive goods and services. The costs associated with higher energy prices will be passed onto consumers through more expensive goods across all sectors of the economy.

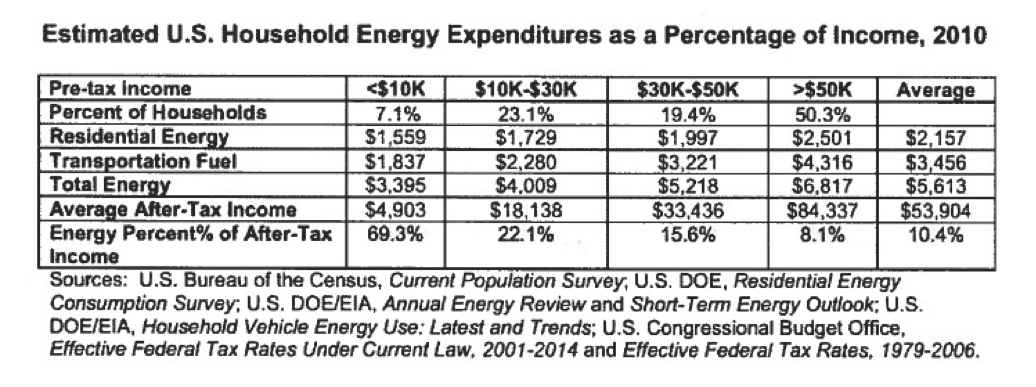

3). It disproportionately hurts low income communities and seniors – The carbon tax is by nature regressive, because it will raise the prices of gasoline, electricity, and other goods by the same dollar amount for all consumers, regardless of their incomes. This disproportionately affects the poor, because energy costs are a bigger portion of their overall budgets. A carbon tax will therefore hurt low-income families and seniors more than it will hurt middle- and upper-class households.

4). It damages American economic competitiveness – More expensive energy and goods damage America’s economic output and overall competitiveness. It will do particular damage to high intensity energy industries like manufacturing. Affordable energy prices in America are one of the main competitive edges we have over our international competitors. For example, in the second half of 2014 the average price of electricity for industrial consumers in the EU was 12 cents/kwH, compared with 7 cents/kwH in the US. A carbon tax would severely undermine that advantage.

5). It may increase air pollution – More expensive energy in America will force companies, particularly those in manufacturing and energy-intensive industries, to shift business operations and the jobs they support overseas. Often times, these countries, such as China and India, have weaker environmental standards and less efficient methods of production. Less stringent standards in these countries are already causing pollution from China to cross the Pacific Ocean and negatively affect the West Coast. A carbon tax would shift more production to these countries, leading to more air pollution.

6). It does not impact climate change – As seen in British Columbia and Australia, carbon taxes do not impact climate change. In BC, a carbon tax was expected to reduce gasoline consumption, but drivers simply went elsewhere to get cheaper gas, like Alberta or Washington State. In Australia, emissions actually increased after the introduction of a carbon tax because of different loopholes and exceptions. Furthermore, even if the U.S. eliminated all carbon dioxide emissions, it would have a negligible impact on the world’s climate. Thus, according to EPA’s own models, imposing a carbon tax in the US will have next to zero impact on the global climate. It would, however, severely damage the American economy.

7). It is not a market-driven solution – Some people claim a carbon tax is a market driven solution for addressing climate change. This first assumes that taxes are an integral part of the free market. This is wrong because taxes are political instruments, not market forces. Calling a carbon tax market driven is like saying we have a more humane way to kill someone. A carbon tax is, fundamentally, a government intrusion into the market that necessarily picks winners and losers. Government officials must ultimately set the level of the tax, which shows that it is a far cry from a “market solution.”

8). It is a tool for politicians to continue wasteful government spending – As with most taxes, a carbon tax is just another tool by politicians to get more money from people to continue to increase the size and scope of the federal government. Instead of reducing unnecessary or wasteful spending, politicians look to things like a carbon tax to continue the gravy train. One only need to look to the recent budget negotiations to see the proclivity for Congress to raid various accounts for their own prerogatives. There is no reason to believe revenue raised from a carbon tax will be treated any differently. Indeed, major green groups are being quite upfront that they want a carbon tax in order to fund their “green energy” projects, schools, and other pet programs.

9). It is not “revenue-neutral” – Some claim that a carbon tax will be revenue neutral, meaning that revenues from the carbon tax will be used to offset or decrease taxes in another area. However, history shows us that this is unlikely to happen. The federal income tax was also intended to be a revenue neutral tax swap that would only tax the richest Americans while phasing out regressive tariffs, yet that has been proven to not be true. Additionally, the idea that a carbon tax can offset the federal income tax or payroll taxes is shaky because the taxes are based on separate tracks: a carbon tax (according to its supporters) provides the “optimal” disincentive for emissions based on models of climate change, while a payroll tax is based on Social Security demographics. Over time, these tracks would diverge and eventually break down, so that even if the carbon tax originally were tied to an “offsetting” cut to other taxes, over time this connection would be severed. Americans would simply have a new tax on energy, on top of the other taxes they suffer.

10). The American public is opposed to it – When asked, the American people reject the idea of a carbon tax, with over 60% of people opposing the idea. This idea only has support among people who want to increase the cost of energy in America.

Aucun commentaire:

Enregistrer un commentaire